Bridging the Gap: Making Strategy a Reality Through Budgetary Alignment

Aligning Your Financial Blueprint with Your Vision for Actionable Success

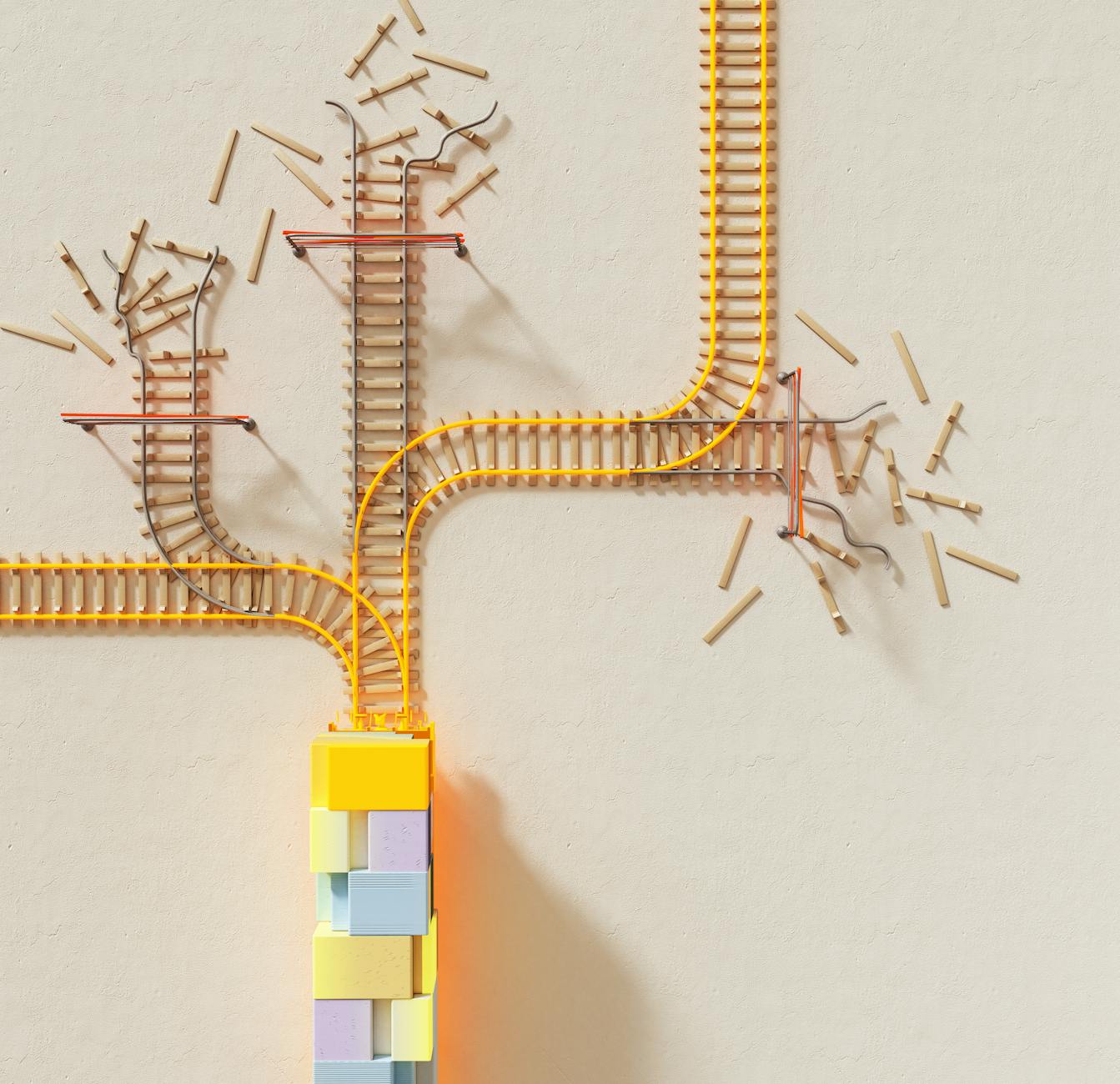

In the complex world of business and organizational management, a compelling strategic plan can often feel like an abstract vision, a well-articulated roadmap without the necessary fuel to reach its destination. Conversely, a budget, while tangible and critical, can sometimes become a siloed exercise in financial stewardship, disconnected from the overarching goals it is meant to support. The chasm between strategy and budget is a well-trodden path leading to missed opportunities, misallocated resources, and ultimately, unfulfilled objectives. This article delves into the crucial process of syncing your budget with your strategic plan, transforming lofty ambitions into actionable realities and fostering clearer communication among leadership.

The alignment of these two fundamental organizational tools is not merely a best practice; it is a prerequisite for effective execution. When a budget directly reflects and facilitates the achievement of strategic priorities, it transforms from a purely financial document into a powerful operational tool. It ensures that every dollar spent is a deliberate step towards the organization’s desired future state, rather than a tangential allocation. This synchronized approach also serves as a vital communication bridge, enabling executives and teams to understand not only what needs to be done, but also how financial resources are being leveraged to accomplish it.

This comprehensive exploration will navigate the nuances of this alignment, examining the foundational principles, dissecting the practical applications, weighing the advantages and disadvantages, and offering actionable insights for organizations seeking to harmonize their financial planning with their strategic aspirations.

Context & Background: The Strategic-Budgetary Disconnect

The disconnect between strategic planning and budgeting is a persistent challenge faced by many organizations. Strategic plans, often developed with great fanfare and considerable intellectual capital, are intended to chart a course for future success. They articulate vision, mission, values, and a set of objectives designed to move the organization forward. These plans typically span several years and require a significant investment of time and resources to formulate.

A budget, on the other hand, is generally an annual financial plan that details expected revenues and expenditures. It is a critical tool for financial control, resource allocation, and performance measurement. However, without explicit linkage to the strategic plan, budgets can become detached exercises, driven by historical precedent, incremental adjustments, or short-term pressures rather than long-term strategic imperatives.

This misalignment can manifest in several ways:

- Resource Mismatch: Strategic initiatives that are deemed critical may not receive adequate funding, while less important or even defunct programs continue to be resourced due to inertia.

- Conflicting Priorities: Different departments or leaders may champion initiatives that are not in sync with the overall strategic direction, leading to internal competition for resources and attention.

- Lack of Accountability: When the budget does not clearly map to strategic goals, it becomes difficult to hold individuals or teams accountable for their contribution to the overall strategy.

- Communication Breakdown: Executives may find themselves discussing strategy in one forum and budget in another, leading to a perception that these are separate, unrelated activities. This can cause leaders to “talk past each other,” as famously highlighted by the Harvard Business Review in its seminal article, “How to Sync Your Budget with a Strategic Plan.”[1]

- Stifled Innovation: New ideas that align with the strategic vision may struggle to gain traction and funding if the budgeting process is not flexible or responsive to evolving strategic needs.

The origins of this disconnect often lie in the separate development cycles and distinct departmental responsibilities for strategy formulation and budget creation. Strategic planning might be led by a dedicated strategy team or executive committee, while budgeting is typically managed by finance departments and operational leaders. Without a deliberate and ongoing process to bridge these two functions, the natural tendency is for them to drift apart.

Historical budgeting approaches, such as zero-based budgeting (where every expense must be justified from scratch) or incremental budgeting (where budgets are adjusted based on previous periods), can sometimes exacerbate this issue if not explicitly tied to strategic goals. While these methods have their merits in terms of cost control, they can lead to a focus on maintaining the status quo rather than investing in future growth and strategic transformation.

Understanding this context is crucial. The strategic plan sets the “what” and the “why,” while the budget provides the “how much” and the “when” in terms of financial commitment. Without a clear connection, the “how much” and “when” can undermine the “what” and “why.”

In-Depth Analysis: Crafting a Harmonized Budgetary Framework

Achieving synergy between strategy and budget requires a systematic and integrated approach. It’s about embedding strategic intent directly into the financial planning process, ensuring that every budgetary decision is a strategic one.

Identifying Strategic Drivers and Key Performance Indicators (KPIs)

The foundation of this alignment lies in clearly articulating the strategic objectives and the measurable outcomes that define success. This involves:

- Deconstructing the Strategy: Breaking down high-level strategic goals into specific, measurable, achievable, relevant, and time-bound (SMART) objectives. For instance, if a strategic goal is to “expand market share by 15% in three years,” this needs to be translated into specific initiatives and quantifiable targets.

- Defining Critical Success Factors: Identifying the key activities, capabilities, and investments that are essential for achieving each strategic objective. These are the levers that will drive progress.

- Establishing Measurable KPIs: For each strategic objective and critical success factor, defining clear Key Performance Indicators (KPIs) that will be used to track progress. These KPIs should directly reflect the desired outcomes of the strategy. The Key Performance Indicators website provides extensive resources on developing effective KPIs.

Budgeting as a Strategic Tool, Not Just a Financial Exercise

The budgeting process itself must be reframed. Instead of being a retrospective allocation of funds or an incremental adjustment, it should be a forward-looking projection of resources required to execute the strategy.

- Zero-Based Budgeting for Strategic Initiatives: While not always practical for day-to-day operations, adopting a zero-based budgeting approach for new strategic initiatives can be highly effective. This ensures that every proposed expenditure for a strategic project is rigorously justified against its expected contribution to strategic goals. The Investopedia article on Zero-Based Budgeting offers a detailed explanation.

- Activity-Based Budgeting (ABB): This approach links budget allocations to specific activities that support strategic objectives. By understanding the cost of activities that drive strategic outcomes, organizations can make more informed decisions about where to invest. Understanding Activity-Based Budgeting can provide deeper insights.

- Rolling Forecasts: Moving away from rigid annual budgets towards rolling forecasts that are updated quarterly or monthly can provide greater agility. This allows for adjustments to be made in response to performance against strategic goals and changing market conditions. The concept of rolling forecasts is crucial for dynamic environments.

Integrating Strategic Plans and Budgets: Practical Steps

The actual integration requires a structured process:

- Develop a Strategic Budget Framework: Create a template or model that explicitly links budget line items to specific strategic objectives and KPIs. This might involve a matrix where each expense category is tagged with the strategic goal(s) it supports.

- Cascade Strategic Objectives: Ensure that strategic objectives are cascaded down to departmental and individual levels. Budgets should then be prepared at these levels, reflecting contributions to the broader strategic goals.

- Scenario Planning: Incorporate scenario planning into the budgeting process. Develop budgets for different potential outcomes or market conditions, assessing how each scenario impacts the achievement of strategic objectives and the required financial resources. The concept of scenario planning is a key tool here.

- Regular Review and Adjustment: Establish a cadence for reviewing budget performance against strategic KPIs. This is not a once-a-year exercise. Regular (e.g., quarterly) reviews allow for timely adjustments to be made, ensuring that the budget remains aligned with evolving strategic priorities. The Protiviti guidance on performance management highlights the importance of regular reviews.

- Cross-Functional Collaboration: Foster collaboration between strategy teams, finance departments, and operational leaders throughout the budgeting and planning cycle. This ensures shared understanding and buy-in.

Leveraging Technology and Tools

Modern technology plays a vital role in facilitating this integration. Enterprise Resource Planning (ERP) systems, Performance Management software, and Business Intelligence (BI) tools can all be instrumental in:

- Connecting strategic objectives to financial plans.

- Tracking budget performance against strategic KPIs in real-time.

- Facilitating scenario analysis and rolling forecasts.

- Enhancing transparency and communication across departments.

Resources on Enterprise Resource Planning (ERP) can provide context on how these systems support integrated planning.

By implementing these analytical approaches and practical steps, organizations can move towards a budgetary framework that is intrinsically linked to their strategic vision, turning plans into tangible progress.

Pros and Cons: The Double-Edged Sword of Alignment

The process of synchronizing a budget with a strategic plan, while highly beneficial, is not without its complexities and potential drawbacks. A balanced perspective requires an examination of both the advantages and the challenges.

Advantages of Strategic-Budget Alignment

The benefits of a well-aligned strategy and budget are significant and far-reaching:

- Enhanced Execution of Strategy: The most prominent advantage is the improved ability to execute the strategic plan. When resources are directly allocated to strategic initiatives, progress is more likely and faster.

- Improved Resource Allocation: Funds are directed towards the areas that will have the greatest impact on achieving strategic goals, minimizing waste on non-strategic activities.

- Increased Accountability: Clear linkages between budget items and strategic objectives make it easier to assign responsibility and measure performance. Leaders can be held accountable for delivering on both financial targets and strategic outcomes.

- Better Decision-Making: With a clear view of how financial decisions impact strategic progress, leaders can make more informed and effective choices.

- Greater Transparency and Communication: When the budget clearly reflects the strategy, it becomes a common language for discussing organizational priorities, fostering better understanding and collaboration among stakeholders. This directly addresses the issue of leaders “talking past each other.”

- Agility and Responsiveness: A process that incorporates regular reviews and rolling forecasts allows the organization to adapt its spending in response to performance data and evolving market dynamics, ensuring continued strategic relevance. The Gartner perspective on agile planning emphasizes this adaptiveness.

- Competitive Advantage: Organizations that can effectively align their strategy and budget are more likely to achieve their objectives, adapt to change, and outperform competitors.

- Investor Confidence: A clear demonstration of how financial resources are being utilized to achieve strategic goals can increase confidence among investors and other financial stakeholders.

Disadvantages and Challenges of Strategic-Budget Alignment

Despite the considerable upsides, organizations may encounter several challenges:

- Increased Complexity: The process of explicitly linking every budget item to strategic objectives can be more complex and time-consuming than traditional budgeting methods.

- Requires Cultural Shift: Successful alignment often necessitates a significant shift in organizational culture, moving from siloed departmental thinking to a more integrated, strategic mindset. This can be met with resistance.

- Data Integrity and Systems: Effective alignment relies on accurate, timely, and integrated data. If financial and operational systems are not robust or well-integrated, the process can be hampered by data integrity issues.

- Potential for Bureaucracy: An overemphasis on rigid linking and approval processes could lead to increased bureaucracy, slowing down decision-making and stifling innovation.

- Difficulty in Quantifying Strategic Impact: Not all strategic initiatives have easily quantifiable financial returns, especially those focused on long-term brand building, culture, or organizational learning. This can make the linking process challenging.

- Resistance to Change: Individuals and departments accustomed to traditional budgeting may resist the new, more integrated approach, particularly if it means reallocating resources away from their established priorities.

- Requires Skilled Personnel: The process demands personnel who not only understand finance but also possess a strong grasp of strategic planning and the ability to analyze complex relationships between activities, costs, and strategic outcomes.

- Over-Emphasis on Short-Term Metrics: While alignment aims for long-term strategic success, if the budgeting process becomes too focused on immediate financial outcomes, it could inadvertently de-emphasize crucial long-term investments or initiatives.

Navigating these pros and cons requires careful planning, strong leadership, and a commitment to continuous improvement. The goal is to harness the power of alignment while mitigating its potential pitfalls, creating a robust system that drives sustainable success.

Key Takeaways

- Clear Strategic Objectives are Paramount: The efficacy of budget-strategy alignment hinges on well-defined, measurable strategic goals that cascade throughout the organization.

- Reframe Budgeting as a Strategic Enabler: Shift the perspective from budget as a control mechanism to a tool that actively facilitates the achievement of strategic priorities.

- Integrate Planning Processes: Develop a unified framework where strategic planning and budgeting are not sequential, isolated events, but interwoven and iterative processes.

- Leverage Technology Wisely: Utilize ERP, BI, and performance management software to connect strategic metrics to financial data, enabling real-time tracking and analysis.

- Foster Cross-Functional Collaboration: Encourage open communication and partnership between strategy, finance, and operational departments to ensure shared understanding and buy-in.

- Implement Regular Review Cadences: Conduct frequent (e.g., quarterly) reviews of budget performance against strategic KPIs to allow for timely adjustments and course corrections.

- Cultivate a Strategic Mindset: Drive a cultural shift that prioritizes strategic thinking and the integrated use of financial resources across all levels of the organization.

- Address Potential Bureaucracy: Design the alignment process to be efficient and agile, avoiding the creation of excessive administrative hurdles that could stifle progress.

- Quantify Impact Where Possible: While not all strategic benefits are easily quantifiable, strive to establish metrics that demonstrate the financial contribution of strategic initiatives to the best of your ability.

Future Outlook: The Evolving Landscape of Strategic Budgeting

The future of strategic-budget alignment is likely to be shaped by several key trends, further emphasizing the need for agility, data-driven insights, and continuous adaptation. As organizations operate in increasingly dynamic and unpredictable environments, the traditional annual budgeting cycle is proving to be too rigid.

Expect to see a greater adoption of:

- Continuous Planning and Forecasting: The move towards rolling forecasts and continuous planning cycles will accelerate. This allows organizations to respond more rapidly to market shifts, competitor actions, and internal performance data, ensuring that budgets remain relevant and supportive of evolving strategies. The Deloitte insights on continuous planning highlight this trend.

- AI and Machine Learning in Financial Planning: Artificial intelligence and machine learning will play a more significant role in analyzing vast datasets to identify trends, predict outcomes, and optimize resource allocation for strategic initiatives. AI can help in identifying hidden opportunities and risks that might impact strategic execution. The EY perspective on AI in FP&A offers a glimpse into this future.

- Scenario-Based Budgeting as Standard: As uncertainty becomes the norm, scenario planning will move from a specialized exercise to a core component of the budgeting process. Organizations will need to develop multiple budget scenarios to adequately prepare for various potential futures and their impact on strategic goals.

- Emphasis on Outcome-Based Budgeting: The focus will shift even further from merely allocating funds to activities to budgeting based on expected outcomes and the value created. This means demonstrating a clear return on investment for strategic spending.

- Integrated ESG (Environmental, Social, and Governance) Budgeting: As ESG factors become increasingly critical for long-term sustainability and stakeholder value, strategic plans will increasingly incorporate ESG objectives. Consequently, budgets will need to reflect the financial commitments required to achieve these goals, ensuring that financial planning is aligned with broader societal and environmental responsibilities. Guidance on ESG principles from the UN PRI provides context.

- Enhanced Data Visualization and Storytelling: To facilitate understanding and buy-in, the presentation of aligned strategic and budgetary information will become more sophisticated, using advanced data visualization tools to tell a clear and compelling story about how resources are being used to achieve strategic success.

Organizations that proactively embrace these future trends will be better positioned to navigate complexity, drive innovation, and achieve sustainable strategic success in the years to come.

Call to Action: Initiate Your Alignment Journey Today

The alignment of your strategic plan with your budget is not a destination, but a continuous journey. It requires commitment, a willingness to adapt, and a strategic mindset that permeates every level of your organization.

To begin or enhance your own alignment process, consider the following actionable steps:

- Assess Your Current State: Honestly evaluate the current relationship between your strategic plan and your budget. Identify existing disconnects, communication gaps, and resource misalignments.

- Review and Refine Your Strategic Objectives: Ensure your strategic goals are SMART and that the critical success factors and KPIs are clearly defined and measurable.

- Educate Your Teams: Conduct training sessions for finance, strategy, and operational leaders on the importance of strategic-budget alignment and the methodologies involved.

- Pilot a New Approach: Consider piloting a new budgeting methodology (e.g., linking budget items to specific strategic initiatives) within a specific department or for a key strategic project.

- Invest in the Right Tools: Evaluate your current technology stack and invest in systems that can support integrated planning, forecasting, and performance tracking.

- Establish Regular Cadences: Implement a schedule for regular strategic-budget reviews and performance reporting to ensure ongoing alignment and accountability.

- Seek External Expertise: If necessary, consult with experienced professionals or consultancies who specialize in strategic planning and financial management to guide your efforts.

By taking these steps, you can begin to build a more robust, responsive, and effective financial framework that directly supports your organization’s strategic ambitions. The time to bridge the gap between vision and execution is now. Start aligning your budget with your strategy today to unlock your organization’s full potential.

[1] Access the foundational article by visiting Harvard Business Review.

Leave a Reply

You must be logged in to post a comment.