Hebl v. Windeshausen Ruling Offers Insight into Creditor Rights

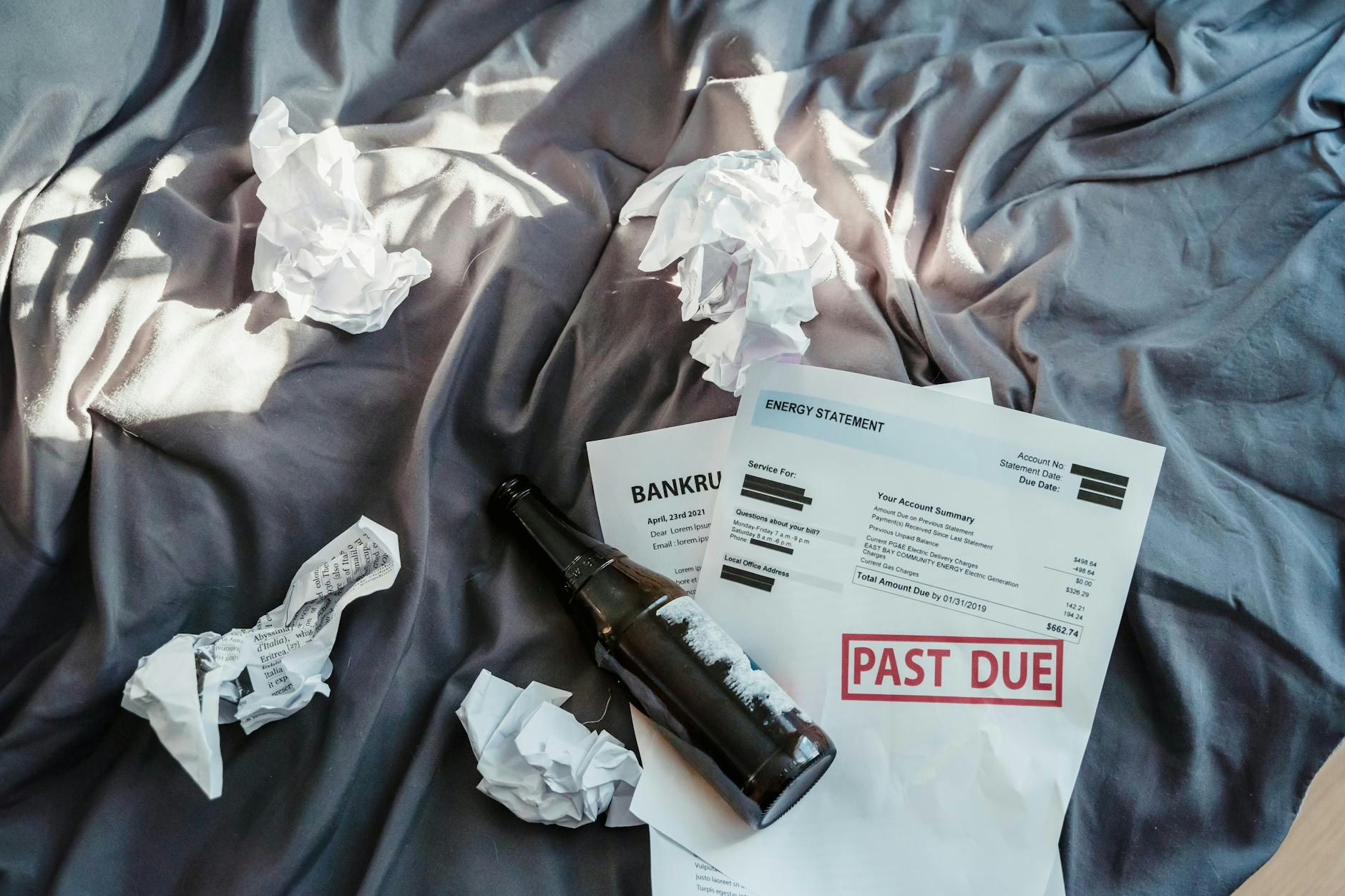

A recent filing from the U.S. Bankruptcy Court for the Western District of Wisconsin, specifically the case of *Hebl v. Windeshausen* (Case No. 15-083), sheds light on the intricate dynamics of bankruptcy proceedings and the limitations placed on discharging certain types of debt. While the case itself is a specific instance, its underlying principles resonate throughout the bankruptcy system, impacting both debtors seeking relief and creditors striving to recover owed funds. Understanding such rulings is crucial for anyone navigating the complexities of personal or business insolvency.

The Legal Framework of Debt Discharge

At its core, bankruptcy law aims to provide a fresh start for individuals and businesses overwhelmed by debt. However, this fresh start is not absolute. Federal law, primarily the Bankruptcy Code, enumerates specific categories of debt that are generally non-dischargeable, meaning they cannot be eliminated through the bankruptcy process. These typically include certain taxes, domestic support obligations, student loans (with very limited exceptions), and debts incurred through fraud or willful and malicious injury. The *Hebl v. Windeshausen* case likely delves into the nuances of proving whether a particular debt falls into one of these non-dischargeable categories, often requiring a legal challenge from the creditor.

Examining the *Hebl v. Windeshausen* Case Details

While the provided metadata offers a gateway to the official court documents, it doesn’t present a narrative summary of the case’s facts or the court’s specific findings. However, the case designation “Hebl v. Windeshausen” strongly suggests a dispute between a creditor (Hebl) and a debtor (Windeshausen) within an adversary proceeding, a lawsuit filed within a bankruptcy case. Such proceedings are often initiated by a creditor seeking to have their debt declared non-dischargeable. The nature of the debt in question – whether it’s alleged to be due to fraud, misrepresentation, or some other form of wrongdoing – would be central to the court’s determination. The court’s decision would hinge on the evidence presented by both parties to prove or disprove the creditor’s claim of non-dischargeability.

Creditor Recourse and Debtor Protection

From a creditor’s perspective, the ability to prove a debt is non-dischargeable is paramount. If a debt is deemed non-dischargeable, the creditor can continue to pursue collection efforts even after the debtor receives a general discharge of other debts. This provides a vital safeguard for creditors who may have been defrauded or harmed by the debtor’s actions. Conversely, debtors face the prospect of continued financial obligations for specific debts, which can significantly impede their ability to achieve a true financial fresh start. The legal burden of proof in these adversary proceedings typically rests with the creditor, who must present compelling evidence to convince the bankruptcy court.

The Tradeoff: Balancing Fresh Starts with Creditor Rights

The tension between providing debtors with a fresh start and protecting creditors’ rights is a fundamental aspect of bankruptcy law. The non-dischargeability provisions represent Congress’s attempt to strike this balance. While bankruptcy should offer relief, it should not become a tool to escape accountability for certain egregious financial behaviors. The outcome of cases like *Hebl v. Windeshausen* underscores the importance of due diligence for creditors and the need for debtors to be fully aware of their obligations, especially those that may survive a bankruptcy filing. The legal interpretation of “willful and malicious injury” or “fraud,” for instance, can be complex and highly fact-specific, leading to litigation.

Implications for Future Bankruptcy Filings

Rulings from bankruptcy courts, even on seemingly straightforward matters, can set precedents or clarify existing legal interpretations. While the full implications of *Hebl v. Windeshausen* are not immediately apparent without a detailed reading of the court’s opinion, such cases contribute to the body of bankruptcy law. They can guide future litigants on how to present their arguments and what evidence is most persuasive. For debtors, it reinforces the importance of honesty and transparency in financial dealings, as certain actions can have long-lasting financial repercussions beyond the scope of a standard bankruptcy discharge. For creditors, it highlights the importance of understanding their rights and pursuing legal avenues when debts arise from fraudulent or harmful actions.

Navigating Debt Discharge: A Word of Caution

Anyone considering bankruptcy or involved in a dispute over debt discharge should seek professional legal counsel. Bankruptcy law is intricate, and the specific facts of each case are critical. Relying on generalized information can lead to costly mistakes. The ability to discharge a debt is not automatic and often requires a court order. Creditors must actively challenge dischargeability for specific debts, and debtors need to understand which debts, if any, are likely to remain. The official court documents for *Hebl v. Windeshausen* can be accessed for a deeper understanding of the proceedings.

Key Takeaways from Bankruptcy Case Law

* **Non-Dischargeable Debts:** Certain debts, such as those related to fraud, willful injury, taxes, and domestic support, are typically not dischargeable in bankruptcy.

* **Creditor’s Role:** Creditors often bear the burden of proving that their debt is non-dischargeable through an adversary proceeding.

* **Legal Nuance:** The determination of dischargeability involves complex legal interpretations and is highly dependent on the specific facts of each case.

* **Importance of Counsel:** Navigating bankruptcy law and debt discharge disputes necessitates expert legal advice.

Further Information and Official Records

For those seeking to review the official documentation related to this case, the following resources are available:

* Descriptive Metadata (MODS) for Hebl v. Windeshausen

* Preservation Metadata (PREMIS) for Hebl v. Windeshausen

* All Content and Metadata files for Hebl v. Windeshausen