Introduction

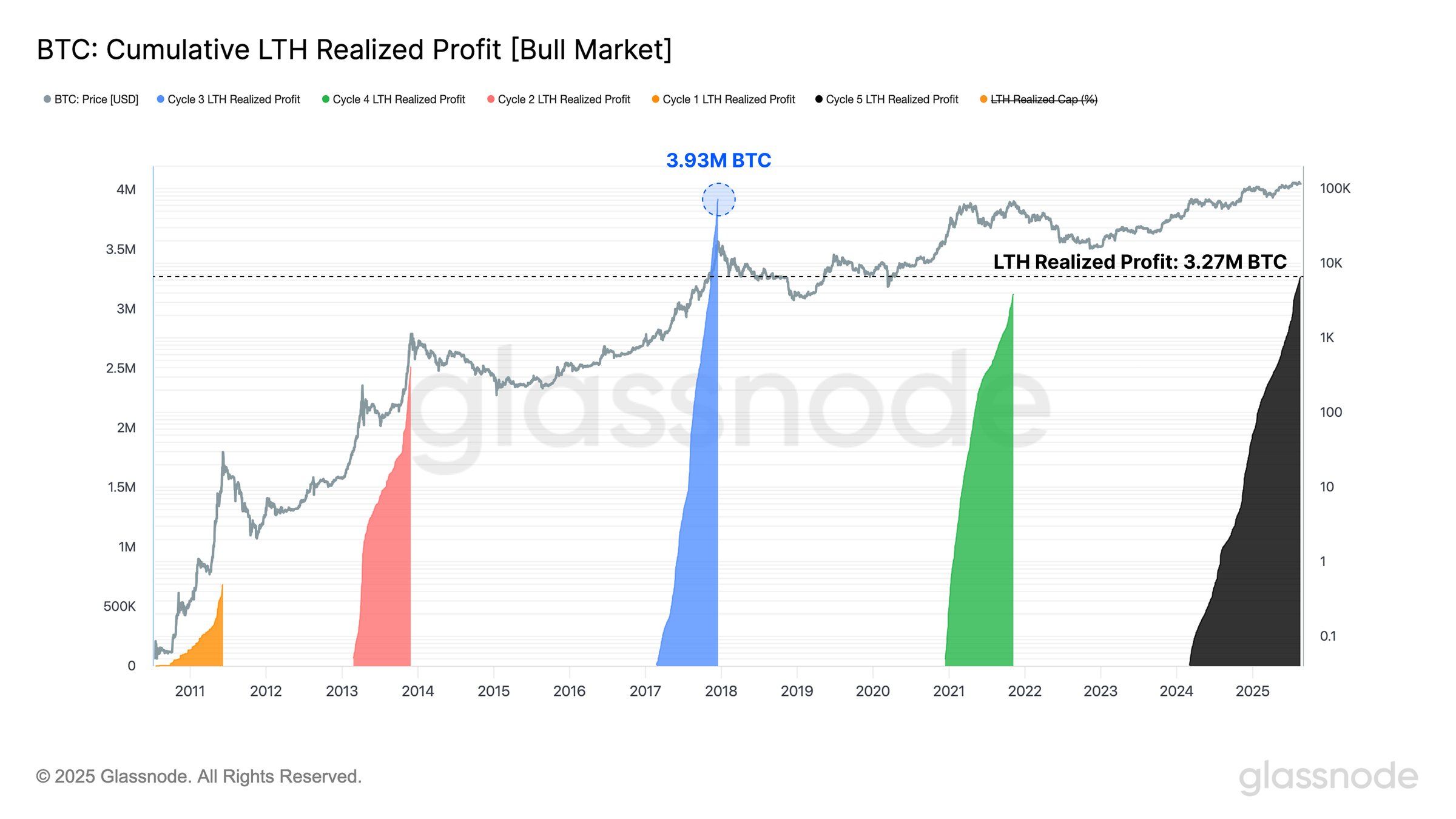

Long-term Bitcoin holders have realized profits totaling 3.27 million BTC during the current cycle, a figure that surpasses the profit-taking observed in the 2021 cycle. This trend indicates intensifying profit-taking pressure within the market, driven by factors such as the movement of dormant coins and the capital rotation facilitated by Bitcoin Exchange-Traded Funds (ETFs). The data, as reported by Glassnode, suggests a significant level of maturity and activity among those who have held Bitcoin for extended periods.

In-Depth Analysis

The current cycle’s profit realization by long-term holders (LTHs) has reached 3.27 million BTC, a notable increase compared to the 2.7 million BTC realized in the 2021 cycle. This metric, derived from Glassnode data, quantifies the amount of Bitcoin that has been moved and sold by holders who have possessed the asset for at least 155 days, at a profit. The increase suggests that a greater volume of previously accumulated Bitcoin, held for a significant duration, is now being transacted at a profit.

Several factors contribute to this heightened profit-taking. The movement of dormant coins, which are Bitcoin addresses that have been inactive for extended periods, is a key indicator. When these dormant coins are moved, especially by LTHs, it often signals a potential intention to sell. The current cycle has seen a substantial number of these coins become active, contributing to the overall profit realization figures.

Furthermore, the advent and adoption of Bitcoin ETFs have played a crucial role in enabling capital rotation. ETFs provide a regulated and accessible avenue for investors to gain exposure to Bitcoin, and importantly, they also offer a mechanism for existing holders to exit their positions more efficiently. This has likely facilitated profit-taking for LTHs who may have previously faced liquidity or transactional hurdles. The ability to easily convert Bitcoin holdings into fiat currency or reallocate capital through ETF mechanisms can accelerate the realization of profits.

The data implies a maturing market where long-term investors are actively managing their portfolios, taking profits as market conditions become favorable. While the exact motivations of each LTH are not detailed, the aggregate data points to a strategic approach to capital management, leveraging the current market environment to secure gains. The comparison with the 2021 cycle highlights a potentially more robust or widespread profit-taking sentiment in the current period, underscoring the evolving dynamics of Bitcoin investment.

Pros and Cons

The primary strength of this trend, as indicated by the data, is the validation of Bitcoin’s potential for significant long-term capital appreciation. The realization of substantial profits by LTHs demonstrates that holding Bitcoin through various market cycles can indeed lead to profitable outcomes. This can attract further investment and reinforce confidence in Bitcoin as a viable asset class. The increased activity also suggests a healthy level of market liquidity and participation.

A potential concern arising from this profit-taking is the downward pressure it can exert on Bitcoin’s price. When a large volume of Bitcoin is sold, especially by holders who have accumulated significant amounts over time, it can lead to increased supply in the market, potentially driving prices lower if demand does not keep pace. This could be viewed as a short-term negative for price momentum. Additionally, the movement of dormant coins, while indicative of profit-taking, could also signal a shift in holder sentiment or a reallocation of assets for reasons other than immediate profit, though the data specifically points to realized profits.

Key Takeaways

- Long-term Bitcoin holders have realized profits of 3.27 million BTC in the current cycle, exceeding the 2.7 million BTC realized in the 2021 cycle.

- This increased profit realization is attributed to the movement of dormant coins and capital rotation facilitated by Bitcoin ETFs.

- The trend indicates intensifying profit-taking pressure within the Bitcoin market.

- The data, sourced from Glassnode, highlights the active management of Bitcoin portfolios by long-term investors.

- The ability of ETFs to enable capital rotation is a significant factor in the current cycle’s profit-taking dynamics.

- While profit-taking validates Bitcoin’s appreciation potential, it can also introduce downward price pressure.

Call to Action

Educated readers should continue to monitor Glassnode’s data on long-term holder profit realization and the activity of dormant coins. Paying close attention to the interplay between ETF inflows and outflows, as well as the broader market sentiment, will be crucial for understanding the sustainability of current price levels and future market movements. Observing whether this profit-taking leads to a significant price correction or is absorbed by new demand will be a key indicator for the health of the Bitcoin market.

Annotations/Citations

Data on realized profits by long-term holders and the comparison with the 2021 cycle are based on Glassnode data as reported by CoinDesk. (https://www.coindesk.com/markets/2025/08/27/bitcoin-long-term-holders-have-realized-profits-of-3-27m-btc-this-cycle-exceeding-2021-cycle)

Leave a Reply